Ozop Energy Solutions (OZSC)

Ozop Energy (OZSC) shows all the hallmarks of a classic pump-and-dump scheme—a Nevada-registered corporation, false press releases, massive share dilution, and some shady characters—including CEO Brian Conway, who previously ran another apparent pump-and-dump. Ozop’s revenue for the first three quarters of 2020 was $1.5 million, versus a fully-diluted market cap currently over $4 billion.

Brian Conway took over as CEO of Ozop on February 28, 2020 (he’s also the CFO, despite no discernible accounting experience, and the sole officer and director of the company as well). On the same day, Ozop filed a letter of intent to buy PCTI, a power electronics manufacturer based in Pennsylvania. Since the acquisition was completed on June 29, Ozop has been hyping up their renewable energy growth potential, although PCTI’s existing business is in low-growth, old-school industrial applications like submarine battery chargers.

Earlier this month, for example, Ozop announced a resale agreement for four EV chargers with Bical Auto Mall, a car dealership in the NYC area. Ozop identified the owner of Bical Auto Mall only as “Mr. Bical”. It turns out this Mr. Bical, full name Lilaahar (Sammy) Bical, was convicted of conspiracy to commit mail and wire fraud in an earlier scheme to defraud GM. Also this month, Ozop was forced to retract an earlier press release touting a supply agreement with WESCO. Ozop’s SEC filings in general have more than their fair share of typos and wrong dates. Needless to say, this all doesn’t give us a lot of confidence in Ozop’s current operations or future prospects.

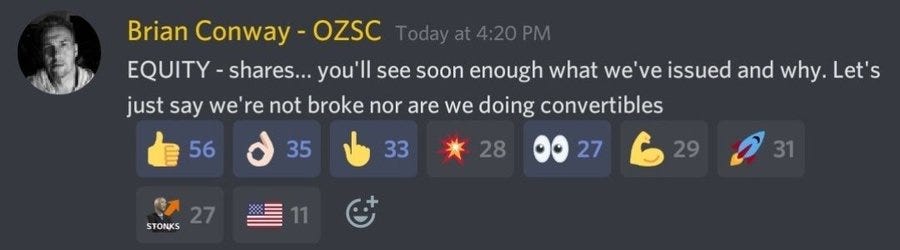

Lacking any credibility or experience in renewables, it’s pretty clear Ozop is simply a scheme to take advantage of the euphoric market lately for any company with even a faint whiff of ESG. And it’s been working. Shares have gone from below a penny for the latter half of 2020, up to 4 cents when the WESCO agreement was announced January 12, and above 30 cents a share recently. Conway himself has been actively pumping the stock on social media, including this gem:

“We’re not broke” isn’t exactly the most reassuring for what is ostensibly a multi-billion dollar company with a bright future.

The dilution at Ozop has been swift and relentless—shares outstanding have more than doubled in the last eight months, up from 1.5 billion to 3.8 billion. But the real whammy is the preferred stock, which is convertible into three times the total number of common shares outstanding, making ongoing dilution three times worse. The fully-diluted share count right now, including the convertible preferred stock, is over 15 billion.

From 2014 to 2019, Conway was the CEO and CFO of Ngen Technologies (fka Liberated Solutions, Liberated Energy, and Go Eco Group), which looks to have been another pump-and-dump scheme:

When the dust settles, I expect a similar result for Ozop too.

Disclosure: Short OZSC